Home Insurance

Save on Your Home Insurance…

Now and Next Year.

Zander lets you shop the nation’s top home insurance companies to find the best rates on the coverages you need, and keeps reviewing your policy every year to make sure your rates stay competitive.

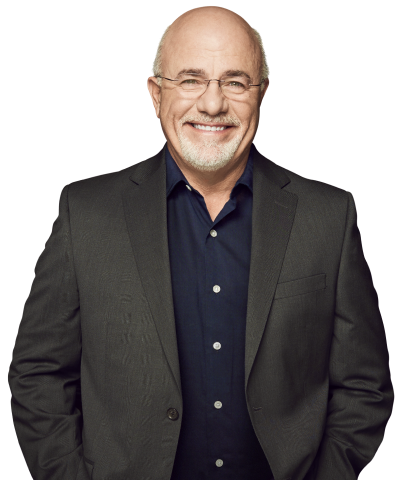

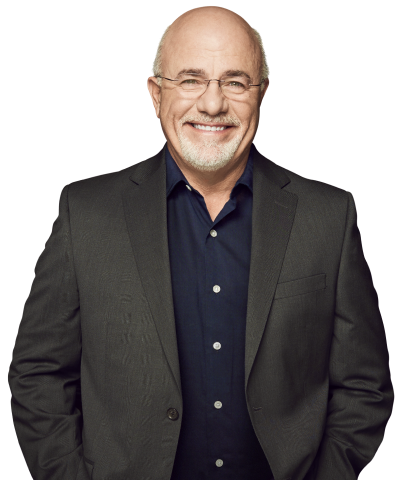

Trust, commitment, experience and great rates are why Zander handles all my insurance.

- Dave Ramsey

Zander Named a 2025 Best Practices Agency

This honor recognizes top firms nationwide for financial strength and operational excellence. For us, it’s about delivering clients the best solutions with an unwavering commitment to service. We Work for You.

From day one, we are here for all your

service needs, helping to keep your life

simple and protected.

We represent the country's top independent home insurers

One central place to get multiple quotes, insuring you get the coverage you need for the most competitive price

Guidance to help you understand the different coverages that are suitable for your insurance needs and your budget

Only with Zander, you get annual reviews of your policy to make sure your rates stay as low as possible

Easy payment options, flexible down payments and personalized service

With four generations and nearly 100 years of experience, we'll be here to help you each step of the way

"Trust, commitment, experience

and great rates are why Zander

handles all my insurance."

- Dave Ramsey

How Home Insurance Helps You:

- It provides you peace of mind after natural disasters.

- Insurance lets you avoid devastating financial losses after a storm, fire, or other damage.

- Coverage has many levels to fit your budget and protection needs.

- Zander Insurance ensures your rates stay competitive each year with annual policy reviews.

Protect Your Finances from Natural Disaster Damage to Your Home

You invest a lot of time and money into your home, so don't let a disaster wipe out your investment. No matter where you live in the United States, your home faces dangers from natural disasters. These can include storms, lightning, and tornadoes, just to name a few. Most types of home insurance cover these disasters, but you should check your policy to verify what is included. Where you live makes a difference in your home's risk and how much protection you need. For example, if you live anywhere that has a tornado season, you should have robust storm protection. If your home suffers storm damage from a tornado or lightning, reach out to your agent for help in filing a claim.

Flood insurance typically comes as a separate policy. If you live in a flood zone, talk to your agent to ensure your home is properly protected. Not all homes will need this type of insurance, and Zander will help you avoid paying for unnecessary coverages by finding the perfect policies for your dwelling and its location.

Is Your Home Insurance Coverage Enough?

Home insurance covers several aspects of your house. Based on the amount of insurance you have on your home, your coverage can provide protection for any or all of the following:

- Costs to rebuild your home

- Replacement costs for your possessions

- Liability expenses if someone sustains an injury on your property

- Living expenses incurred while your home receives repairs or is rebuilt

Having coverage for various aspects of your home is only one part of a homeowner's insurance policy. To avoid underinsurance, you need to know at what value to insure your home what value to insure your home. This amount ties into how much your insurance will pay out if you must file a claim. If you have major changes, such as adding a room to your home or converting a basement or garage into an apartment, let your agent know to ensure that you maintain the right amount of coverage for your home's value.

Are You Ready to Protect Your Home?

Don't wait for a disaster to happen. Your home should be properly insured before anything happens to it. Zander Insurance works with over two dozen home insurers around the United States to get you the right coverage. We will advocate for you throughout the buying process and even help you with filing claims. You're not alone when you have Zander Insurance at your side to help with your homeowner's insurance coverage.